YOUR GUIDE TO REACHING FINANCIAL FREEDOM WITH DIVIDENDS

Join 15k+ savvy investors reading the newsletter, and let Retire With Ryne grace your inbox every week as you build your perpetually growing, cash-flowing dividend stock portfolio.

WARNING: It’s A Dividend Yield Trap

A dividend yield trap is a situation where an attractively high dividend yield masks underlying issues within a company, eventually leading to disappointment for investors. Fortunately, dividend yield traps can be pretty easy to identify.

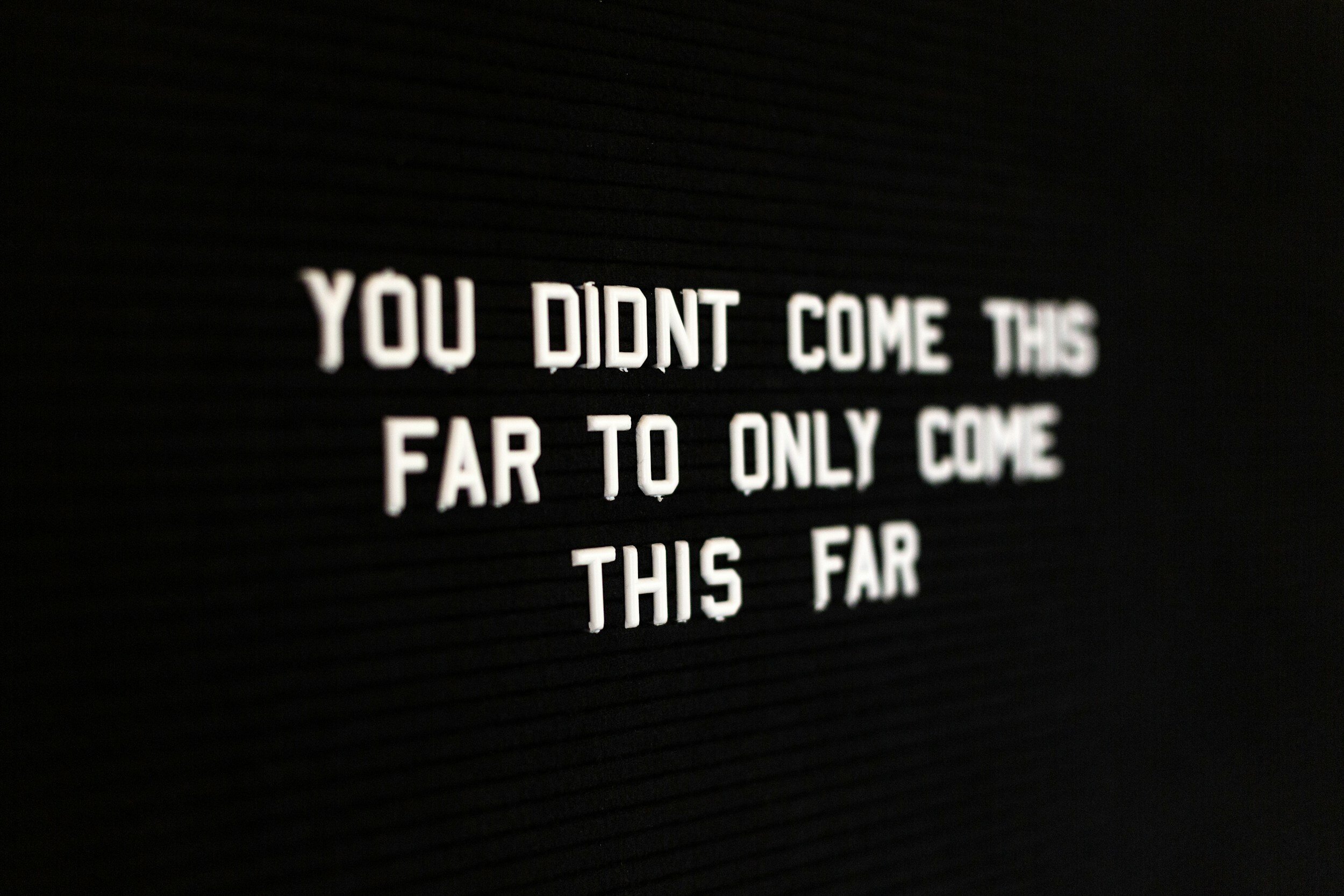

The "Boring Middle" of Investing

You know how it goes: You start something new, and at first, it's super exciting—maybe even a bit obsessive. But after a while, whatever that thing is starts to lose its luster, and you find yourself in this "boring middle" where things begin to feel more routine, and possibly a bit monotonous. I think every investor reaches this “boring middle” in their dividend investing journey (probably more than once) and this is how it happens.

My Top Dividend Stock For February

While there are actually quite a few good looking dividend stock deals on the market right now, one in particular has captured my attention and, more importantly, my investment dollars. This is my top dividend stock for February 2024.

The Longevity Dividend

In 2021, people around the world were living, on average, just over 70 years. That’s pretty amazing when you consider that only 200 years ago, people were only making it to about half that age. This remarkable increase is thanks to various improvements in science, healthcare, and global living conditions, along with something called "The Longevity Dividend.”

Every Investor Should Do More of This In 2024

Charlie Munger was a voracious reader, and used to say that investing is a subset of "worldly wisdom." He also said that, "If it’s wisdom you are after, you are going to spend a lot of time sitting on your a** and reading.” So, connecting the dots here, becoming a wise and experienced investor is going to require an immense amount of reading, which makes sense, and is an idea that all investors should pay attention to.

My Dividend Investing Goals For 2024

As we close out 2023, and gear up for what's sure to be another interesting ride in 2024, I wanted to spill the beans on my dividend investing goals for the upcoming year.

Is It Too Late To Start Investing?

I recently got an email from a member of our community here. He’s 40 years old, so 10 years older than me, and instead of getting excited about what lies ahead, he's worried about the future of his dividend stock portfolio.

I’m Making A BIG CHANGE To My Portfolio

They say your portfolio is like a bar of soap – the more you handle it, the smaller it gets. I'm a firm believer in that analogy, and try my best not to tinker with my dividend stock portfolio too much. Yet, every now and then, change becomes inevitable.

The Most Important Question For Every Investor

One of the hardest parts about dividend investing is learning how to analyze a company and knowing what to look for, especially if you’ve never done it before. This is step #1 in my own dividend stock research process.

A Dividend Investor's Greatest Ally

Building wealth with dividend investing is a slow burn. If you’re starting from scratch, it will realistically take a number of years for your dividend snowball to really take off. Many people don’t want to hear that. Many prefer a quicker process, and are looking for the fast track to financial freedom, but that’s not really how it works.

BLESSED BY DIVIDENDS

As we celebrate the Thanksgiving holiday, I want to express my gratitude for this incredible journey we embark on together as dividend investors. This year has been rewarding in more ways than one, and I'm excited to share some of the reasons why I'm feeling thankful this year.

I’m Going To Sell This Dividend ETF

Parting ways with a stock is never easy. We dividend investors typically buy with the intent to hold forever – or at least until the dividends stop flowing. With that said, it’s easy to get attached to the dividend stocks you hold, but it’s also important to know when to fold ‘em.

The Key To Avoiding Dividend Cuts

Dividend cuts are the worst, and if you plan on investing for any extended amount of time, you're likely to experience at least one of them yourself.

This Popular Investing Metric Is Seriously Flawed

There are countless metrics used by investors to try and explain why a certain dividend stock may be a good/bad investment, but as is the case with most things, the context in which you apply them is incredibly important.

Master Your Dividend Domain

The ability to think for yourself and make your own decisions is paramount as a dividend investor. This is not to say that you should completely ignore the insights of others and not learn from more experienced investors, but blindly following the herd can lead to a lack of control over your portfolio and your financial future.

My BIGGEST Dividend Payment Ever

Dividend investing is a lot like playing a video game. The longer you play, and the deeper you get into the game, the more experience points (XP) your character will accrue, and the same thing actually happens as an investor. The more you invest, and the longer you do it, the more you will level-up and reach new milestones in your portfolio.

3 CHEAP Dividend Stocks PERFECT For Any Investor's Portfolio

Generally, stocks with high dividend yields don't tend to offer much dividend growth (if any), while those that do have a tendency to aggressively increase their dividends rarely have high yields. With that said, there are always exceptions to the rule. Some stocks exist that can play on both ends of the spectrum, and come complete with both a high yield AND a respectably high dividend growth rate.

This Is Like Christmas For Dividend Investors

The stock market is known for its ups and downs, and it's the down periods that truly test our mettle as dividend investors. With that in mind, market fluctuations can work in your favor, and volatility is something to be taken advantage of.

3 Easy Ways To Find Cheap Dividend Stocks

When you buy an undervalued dividend stock, not only are you stretching your investment dollars further, but you're also able to lock in a higher dividend yield and establish a greater margin of safety. Here are three ways to find cheap dividend stocks.

How To Crush The Market With "Toll Booth" Stocks

As dividend investors, we prioritize stability and reliability, and there's no better place to find these qualities than in a "toll booth" company.