I Made A BIG MISTAKE With This Dividend Growth Monster

Disclaimer: This page contains some affiliate links that might just lead you to the promised land of awesomeness (or at least some cool products). I personally use all of the products promoted, and recommend them because they are companies I have found to be helpful and trustworthy. I may receive commissions for purchases made through links in this post.

If you plan on investing for any extended period of time (which I hope is the case!), you’re going to make some mistakes. It’s inevitable—but not all mistakes are created equal.

On one side, you’ve got errors of commission. These mistakes come from a decision made that turns out to be less than ideal. For example, maybe you invested in a company that doesn’t quite live up to its potential, or maybe you sold out of an excellent company right before its big run-up.

On the other side of that, you've got errors of omission, which come from the decisions you don’t make. These are the opportunities you let slip through your fingers because you hesitated and didn’t take action when you should have.

Warren Buffett addressed these concepts in his 1989 shareholder letter, emphasizing that some of his biggest mistakes in investing weren’t from the bad investments he made, but instead were from missing out on the good ones he could have made. He wrote:

“Some of my worst mistakes were not publicly visible. These were stock and business purchases whose virtues I understood and yet didn’t make. It’s no sin to miss a great opportunity outside one’s area of competence. But I have passed on a couple of really big purchases that were served up to me on a platter and that I was fully capable of understanding. For Berkshire’s shareholders, myself included, the cost of this thumb-sucking has been huge.”

Unfortunately, I think I made this same kind of mistake with Zoetis (ZTS).

For those who aren’t familiar, Zoetis was spun off from Pfizer back in 2013 and is the global leader in animal health. They make medications, vaccines, and other health products for animals, focusing heavily on livestock and companion pets like cats and dogs.

A significant driver of this company’s success is what they refer to as the "human-animal bond." Essentially, this bond means that pet owners, particularly Gen-Z and Millennials, consider their pets to be more than just pets…they’re family members.

Source: Investor presentation

As such, the health and wellness of their pets is top priority. Even during economic downturns, these pet owners are willing to spend whatever they need to on veterinary care, which certainly bodes well for Zoetis.

The company has some fascinating data to back this up. In their most recent earnings call, their CFO shared that 86% of pet owners would spend whatever it takes if their pet needed extensive veterinary care.

Even more interesting, if pet owners experienced a 20% drop in income, they said they’d still spend the same amount on their pets' health. This tells us that Zoetis is in a strong position to continue thriving, especially as younger, more affluent pet owners view veterinary care as a non-negotiable part of their lives.

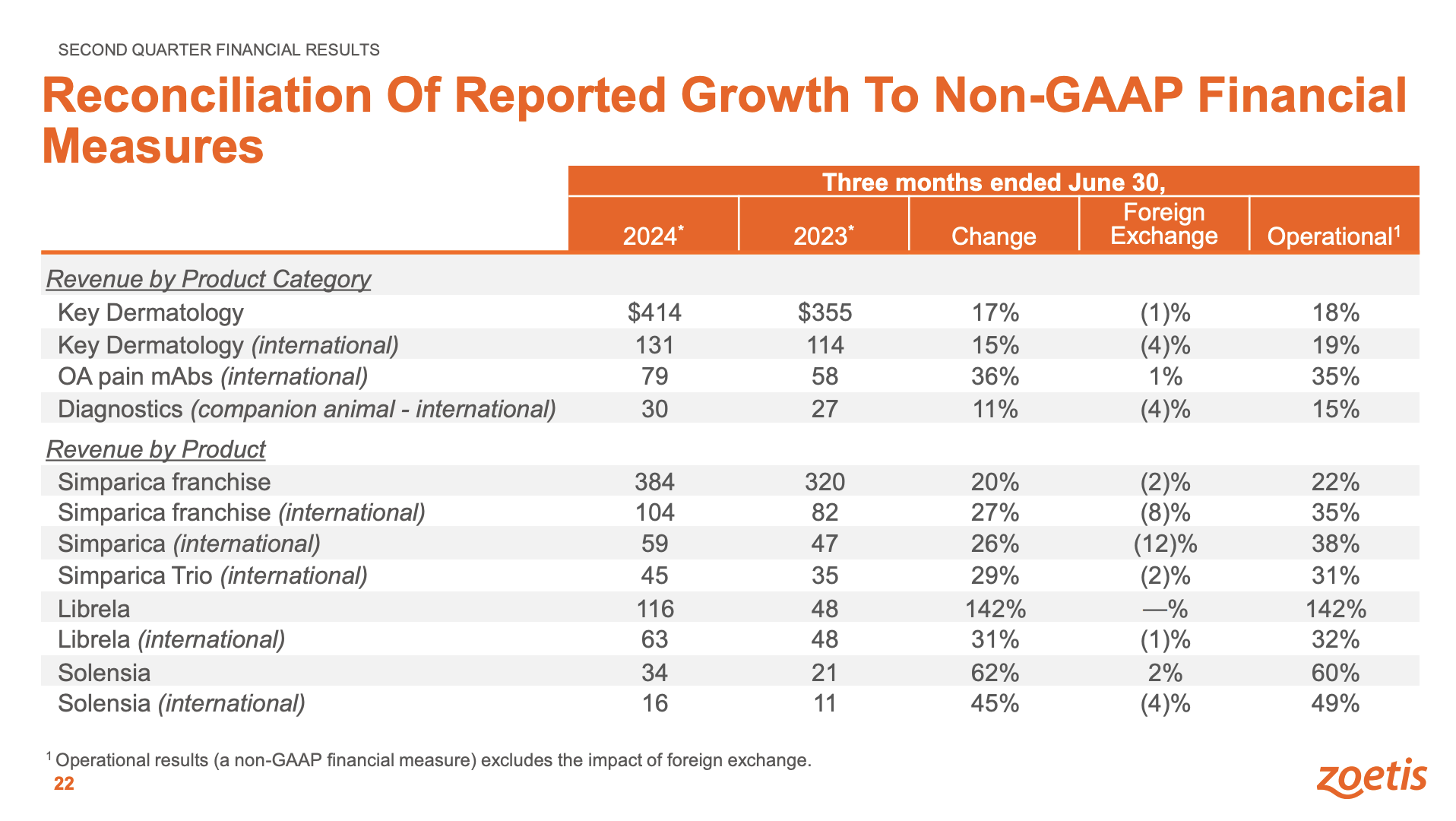

Their financials reflect this strong demand too. In the last quarter, all of their drugs saw double-digit sales growth year-over-year, with one of their top products, Librela, skyrocketing by nearly 150%.

Source: Earnings Presentation

Overall, both the company’s revenue and earnings were up by double digits year-over-year. And what’s even more impressive is that their earnings are growing faster than their sales, which means Zoetis isn’t just growing—it’s becoming more profitable over time.

Source: Zoetis's profitability metrics using Snapstock, a new stock analysis tool I've been working on (coming soon)

Looking back, it seems like investing in Zoetis would have been a no-brainer. This was a company I knew had great potential (it was my top dividend stock to buy a few months back), but instead of pulling the trigger, I was too busy sucking my thumb.

When I first started talking about this company back in April, the share price was at around $166 per share. Not long after, the price dipped to about $145 per share—an even better buying opportunity in hindsight. Since then, the stock has steadily climbed to around $190 per share.

So, why didn’t I buy?

The simple answer: I didn’t feel like I’d done enough research. Even though I recognized Zoetis’s potential, I wasn’t confident enough to make a move without getting more familiar with the company.

In a video from earlier this year, I mentioned that I was torn between investing in Zoetis or VICI Properties (VICI). Ultimately, I went with VICI because I felt more comfortable with it—it was more in my wheelhouse, so I spent more time digging into that company.

And, to be fair, VICI has worked out well for me. But still, I can’t shake the feeling that I let a great opportunity slip by with Zoetis, and this isn’t the first time I’ve made this kind of mistake.

I did the same thing with Rollins (ROL), and I almost did it again with Williams-Sonoma (WSM). I vividly remember almost passing on WSM because its price jumped from around $114 to $130 (pre-split), and I nearly missed out on what turned out to be a great investment.

Even with VICI, I hesitated because I was concerned about having too many REITs in my portfolio.

The point I’m trying to make is that I’ve let a few good opportunities pass me by, often for reasons that, in hindsight, are trivial. The lesson I’ve learned from these experiences is that I tend to move too slowly.

If I suspect that a solid company is undervalued, I need to be quicker in exploring that opportunity rather than letting it slip by.

And all of this raises an important question: Is it too late to buy Zoetis now? To answer that, we can look at several valuation metrics.

Averaging these out gives us about $172 per share, which is below the current price. Personally, I’d wait for a bit of a pullback before buying any shares.

While Zoetis might not be an immediate buy at its current price, the experience has taught me an important lesson: In investing, sometimes the biggest mistakes aren’t the bad opportunities you take—they’re the good ones you let pass by.

Speaking of opportunities, I think I’m seeing a pretty decent one starting to pop up with LVMH, which I’m telling you more about here.

Now with all of that said, I want to hear from you: What have been some of your missed opportunities in the stock market? Write to me here and let me know.

Dividend Investing Democratized

Join thousands of savvy investors in the pursuit of early retirement. Get Retire With Ryne delivered straight to your inbox every week as you build your perpetually growing, cash-flowing dividend stock portfolio.

Blossom is a unique social platform created by investors, for investors. Unlike the usual social media platforms, Blossom is dedicated exclusively to discussions on finance and investing.

I've been actively posting on Blossom since November, and I absolutely love the community over there. With over 120,000 DIY investors, Blossom is buzzing with all sorts of different investment ideas. The coolest part is that you can see everyone's portfolios, which you can automatically link within the app!

Picture Twitter/X, but with an added portfolio tracking feature and less trolling – that's Blossom for you. Personally, I find it much more enjoyable than my experience on Twitter/X, and I think you will too.

Download Blossom today, and follow me (@ryne) to see my complete portfolio and stay updated on all my real-time investment moves.

IN MY PORTFOLIO 📈

Portfolio performance provided by Snowball Analytics

ICYMI 🎥

Starbucks SKYROCKETS Over 24% - My BIG Concern

Earlier this week, Starbucks announced that their CEO, Laxman Narasimhan, would be stepping down immediately after only being with SBUX for a year and some change. In this video, I'm sharing my thoughts on the news, along with a few lingering concerns I still have despite the change in leadership.

CAREFULLY CURATED 🔍

📺 Fundsmith's Annual Meeting - In this video, you'll hear from Terry Smith, often called the British Warren Buffett, as he discusses Fundsmith's performance results for 2024 and fields questions from the audience.

🎧 The Art of Quality Investing - How do you identify the best companies in the world? That's the focus of this episode of the Investing By the Books podcast with Pieter Slegers, founder of Compounding Quality and author of The Art of Quality Investing.

📚 If You Had To Retire Today... - There are plenty of ways to plan for retirement, but in this article, Nicholas Ward—one of my favorite writers on Seeking Alpha—lays out the specific strategy he'd use if he had to pull the retirement trigger today.

SINCE YOU ASKED 💬

"First time investor...do you have a checklist on what to look for in dividend stocks?"

- Valiant Valryn | YouTube

So I actually have a fully comprehensive process that I follow using my Investors Almanac tool (coming soon), which spans everything from a company's background, financials, management, valuation, and more.

Having said that, a brand new investor might be looking for something less intense, in which case there are three key things I think any brand new investor can and should look for:

The first and most crucial thing is to determine whether you truly understand the business. Once you’ve identified a stock that piques your interest, ask yourself—do you genuinely understand the company’s business model and how it generates revenue?

If the answer is yes, that’s a big win. It means this company falls within what Warren Buffett calls your Circle of Competence. For dividend investors, staying within this circle usually leads to smarter investment decisions and can help you determine which companies might be able to continue paying and growing their dividends over time.

Once you’ve found a business you understand, the next step is to check whether it’s growing. You can do this by digging into the company’s financial statements.

Learning how to read these statements is a non-negotiable if you’re serious about researching individual companies. Here’s a quick breakdown of the three key financial statements:

Income Statement: This shows a company's income and expenses over a specific period, revealing whether the company made a profit or took a loss.

Balance Sheet: This offers a snapshot of the company’s assets and liabilities, along with its book value, which is the difference between the two.

Statement of Cash Flows: This tracks how cash moves in and out of the business. For dividend investors, this is crucial because dividends are paid from the company’s free cash flow.

To figure out if a business is growing and has long-term potential, you’ll want to at least look at its free cash flow, revenue, and earnings. Ideally, you want to see all three trending upwards over time.

Source: Visa's growth metrics using Snapstock, a new stock analysis tool I've been working on (coming soon)

Finally, once you’ve found a growing business you understand, the third step is to assess whether the dividend is sustainable. The quickest way to do this is by looking at the “Payout Ratio.”

This ratio tells you the percentage of a company's earnings that goes toward paying dividends. A lower payout ratio (around 50% or below) generally means the dividend is less of a financial strain on the company, making it easier to sustain and grow over time.

In a nutshell, these are a few quick checks you can use to decide whether a dividend stock is worth exploring further. Your checklist will likely expand over time, but I think these three things are a great place to start.

Have a question? Ask me here to see it featured in an upcoming newsletter.

HOT TAKES 🔥

Last week, I asked readers if they invest in any covered call ETFs. Here are some of the responses:

Matt said: As a dividend investor of about 1 year, I stay away from them because I got the overall feeling that they might be complicated, which is what I don’t want, but also don’t for the same reasons you outlined.

Mary Ann said: Like you, I avoid them longterm. But after the market drops, they tend to bounce when everyone decides it's safe again.

John said: I’ve actually found covered call ETFs to be a solid part of my portfolio. I know they’re not for everyone, but I like the steady income they provide since I’m more focused on generating cash flow rather than high growth.

Carlos said: I looked into covered call ETFs after hearing about the high yields, but I decided against it after researching. It seemed like too much of a gamble for me, especially when I’m more comfortable with straightforward dividend stocks that I can understand and trust.

LAST WORD 👋

I love hearing from you all, and I'm always looking for feedback. How am I doing with the newsletter? Is there anything you'd like to see more of or less of? Which aspects of the newsletter do you enjoy the most?

Your insights on these matters are essential in making this newsletter the best it can be. If you want to help, take a moment to share your thoughts by completing this quick form. It'll take you less than 60 seconds - guaranteed.

Thanks in advance!