This Dividend Stock Just Doesn't Quit

Disclaimer: This page contains some affiliate links that might just lead you to the promised land of awesomeness (or at least some cool products). I personally use all of the products promoted, and recommend them because they are companies I have found to be helpful and trustworthy. I may receive commissions for purchases made through links in this post.

In the few short years that I’ve been investing, none of my holdings have moved with the ferocity that Williams-Sonoma (WSM) has.

As I write this today, Williams-Sonoma’s share price is in the midst of a 17% surge following the release of their latest quarterly earnings report, where they surpassed expectations on both the top and bottom line. This surge marks just one chapter in what has been an impressive year for the stock, with its price soaring over 145% in the last twelve months alone, and possibly more by the time you’re reading this.

Source: Seeking Alpha | WSM share price return vs the S&P 500 (1Y)

But what exactly is driving this success story? Let's delve into the company a bit more.

Founded in 1956 by Chuck Williams, the company began as a humble store in Sonoma, California, specializing in French cookware. Williams' dedication to quality and customer service set a high standard that propelled the business to become the world's largest digital-first, design-led, and sustainable home retailer.

Chuck Williams, founder of Williams-Sonoma

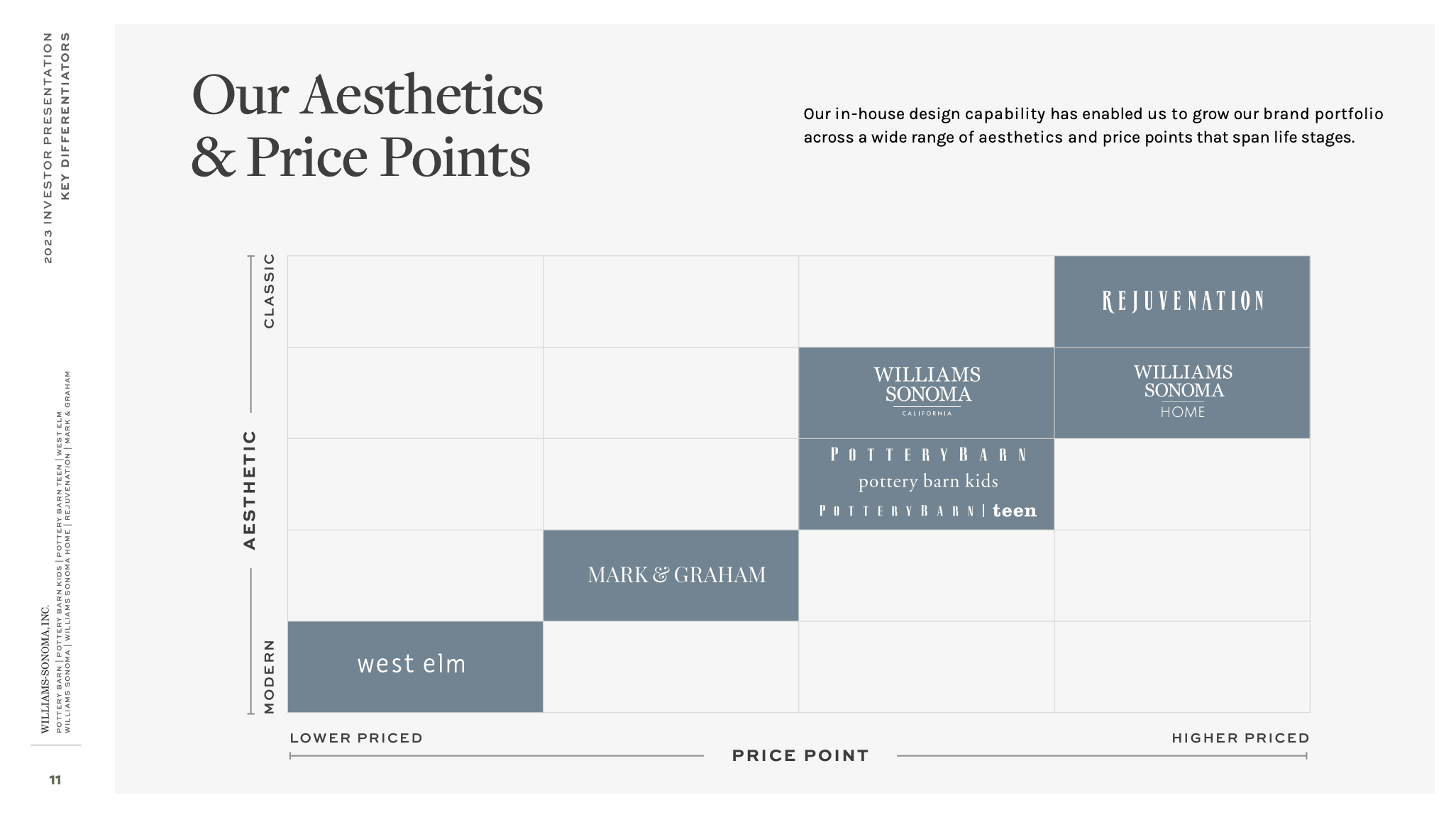

While Williams-Sonoma is most known for its high-quality kitchen products, what many people don’t realize is that the company also owns several other popular home furnishing brands like Pottery Barn, West Elm, and Rejuvenation.

In an industry as fragmented as home furnishing, the company’s brands are some of the most recognizable, which is one of their competitive advantages, and their diverse portfolio helps them cater to customers across various budgets and tastes, bolstering their sales and market presence.

Source: Williams-Sonoma Investor Presentation

In addition to brand recognition, some other strengths that set Williams-Sonoma apart are the company’s in-house design capabilities and their unmatched digital presence, with 66% of the company’s sales coming from e-commerce channels.

Source: Williams-Sonoma Investor Presentation

Moreover, the company's financials speak volumes about its success. I cover them in more detail here, but here are some of the quick stats:

Their revenue has grown by 7.52% every year for the past five years.

Their earnings per share (EPS) has grown by 34.40% every year for the past five years.

Their free cash flow has grown by 30.58% every year for the past five years.

They have no debt on their balance sheet. It's hard to go bankrupt when you're debt-free.

They’ve been buying back shares very aggressively with 98.8M shares outstanding in 2014, compared to 65.7 million shares outstanding today.

Overall, as an increasing amount of money enters the business, an increasing amount is being kept by the business after all expenses, taxes, and other financial obligations are accounted for. This is exactly what you want to see.

On top of that, they've increased their dividend by a whopping 16% on average every year for the past five years, and just announced another generous increase—at 26%—which has us shareholders jumping for joy.

Speaking personally, Williams-Sonoma has been my best investment by a long shot, and is the first stock in my portfolio to double in value. That’s pretty incredible in its own right, but the sheer speed at which this has happened is mind-blowing to me.

As a result, Williams-Sonoma is now the third largest position in my portfolio, and is quickly gaining ground on my two largest positions, Realty Income (O) and Johnson and Johnson (JNJ).

Source: getquin | My top 3 largest holdings

Although it's starting to get tempting to cash-in on these gains, I believe in letting your runners run, especially if the underlying company is still firing on all cylinders. So far, Williams-Sonoma has been the gift that keeps on giving, so I'm just going to let it do its thing, and am keeping my fingers crossed for continued success.

With that said, I want to hear from you: What’s your best performing stock of all-time? Write to me here and let me know.

And a big thank you to all of the readers who responded to last week's newsletter! You can read some of the responses down below in the "Hot Takes" section. 👇

Dividend Investing Democratized

Join thousands of savvy investors in the pursuit of early retirement. Get Retire With Ryne delivered straight to your inbox every week as you build your perpetually growing, cash-flowing dividend stock portfolio.

I don’t know if you've ever Googled your name before, but just imagine casually searching for yourself and finding a whole list of shady websites offering up your most private information to anyone willing to pay a few bucks. It’s terrible, and the worst part is you have no control over it.

I recently experienced this firsthand. When I searched for myself online, I was genuinely shocked when I found that numerous websites had my full name, birthday, address, phone number, email address, and even the names of my relatives out there in the open for the world to see.

Thankfully, this is where Aura comes in. Aura identifies which data brokers are selling my information and automatically submits opt-out requests on my behalf to remove that information from those exploitive websites.

So far, Aura has been able to remove my information from almost twenty of these different sites, and is working around the clock to make sure I stay off of them.

Aura also provides proactive protection with its antivirus software, VPN, password manager, fraud monitoring (which allows you to monitor your bank, brokerage, and retirement accounts), and even identity theft insurance.

As time goes on, these scammers are only getting more sophisticated. If you want to protect your personal and financial information from being exposed and exploited online, then you need to start using Aura, which you can actually do for free with a 14-day trial.

I couldn't be happier with my experience so far, and I think you'll find Aura to be just as beneficial. Definitely check out that 14-day free trial, and don't hesitate to reach out if you have any questions. I'm happy to help!

IN MY PORTFOLIO 📈

Track your portfolio for free with getquin. You can also follow mine there (@ryne) to see all of my purchases, dividends, and other updates in real-time.

ICYMI 🎥

SCHD Reconstitution 2024: Everything You Need To Know

Every year, on the 3rd Friday in March, SCHD does what's called a "reconstitution." Essentially, this is a reorganization of the holdings inside the fund, and this video covers all of the changes from this year's reconstitution.

CAREFULLY CURATED 🔍

📺 The True Value of Paying Off Your Home - I'm really drawn to the idea of living rent/mortgage free (hopefully in the future), and it's fascinating to learn from others who have achieved the goal of owning their home outright. My friend JJ Buckner is one of those people, and he shares what it's actually like living mortgage-free in this video.

🎧 Soul In The Game - Vitaliy Katsenelson, who runs Investment Management Associates, is an investor I've been learning a lot from lately. I've been reading his newsletter for a while now, and was excited to hear from him on this episode of the Hidden Forces podcast, where he talks everything from investing tips to staying calm during uncertain and turbulent times. The episode is a couple years old, but the information and key takeaways are still relevant today.

📚 Hold Fast - I didn't realize Chris Mayer, author of 100 Baggers, had a blog until recently. I really enjoy his writing, and think you'll like this article on finding the strength to hold onto your stocks during times of uncertainty.

SINCE YOU ASKED 💬

"How do you determine your position size for each stock? I'm researching before I invest and I'm having trouble deciding how much of my portfolio to put into each stock."

- Caleb | Email Submission

Honestly, I don't have a strict method for managing this. The most I do is set a maximum size for each stock, like not letting any one position make up more than 10% of the portfolio in terms of dollars invested or dividend income generated.

There are exceptions to this, but I'll typically buy a stock until it's not at a great value anymore or until it gets close to the limits I mentioned above. I figure that over time, my investments will naturally balance out and diversify.

Have a question? Ask me here to see it featured in an upcoming newsletter.

HOT TAKES 🔥

Last week, I asked readers what draws them to dividend investing. Here are some of the responses:

Pat said: I invest in dividend stocks because usually they are solid companies I don't have to worry about going under unexpectedly, I always have some sort of money coming to me no matter what the market is doing, and since I re-invest dividends, it is a set-it-and-forget-it way of dollar cost averaging.

Dan said: My favorite thing about dividend investing is the fact that I don't have to sell my shares to get the income.

Trevor said: I'm pretty new to investing (4 months in), and I've found that most of the companies I'm familiar with pay dividends. I wasn't looking for dividends specifically at first, I just fell into it because of that. But I'm loving those paychecks so far, and am excited to keep growing this thing!

LAST WORD 👋

I've been posting on Instagram pretty much every day, and I'd love to connect with you there.

I'm sharing daily portfolio updates along with some other behind-the-scenes stuff that I think you'll really enjoy. It's been a lot of fun posting on my story every day, and as time goes on, I'll be using this platform more and more.

Just click here to visit my profile and say hello - I'd love to hear from you!