How To Find Your "Investable Universe"

Disclaimer: This page contains some affiliate links that might just lead you to the promised land of awesomeness (or at least some cool products). I personally use all of the products promoted, and recommend them because they are companies I have found to be helpful and trustworthy. I may receive commissions for purchases made through links in this post.

One of my favorite things about investing is how much you learn about a wide variety of subjects. As an investor, you'll naturally gain knowledge in business, accounting, economics, psychology, philosophy, and many other areas. Most importantly, you'll learn a lot about yourself.

In my opinion, investing is as much a journey of personal growth as it is a path to financial growth. One of the most important (and humbling) things you’ll come to know about yourself is what you actually don’t know.

Unfortunately, you won’t have a good gauge on what your limitations are when first starting out. This is something most investors have to learn the hard way.

Only with time and experience (for better or for worse) will you develop a sense of which businesses you understand and which you don’t. This awareness will change how you approach new investment ideas. The first question you'll start asking yourself about a new business is: Do I understand it?

By doing so, what you’re really asking is: Do I understand how this business makes money? Do I understand its industry? Do I know what makes it a good business? Can I perceive the potential risks it faces?

These sorts of questions aren’t usually your first focus when you start investing, but they’re critical to selecting suitable long-term holdings for your portfolio.

For me, it all starts with understanding how the business makes money, and sometimes even that is too complex for me.

For example, someone recently recommended that I look into a company called Booz Allen Hamilton (BAH). On the surface, it looked like a financially sound company—solid revenue and earnings growth, low payout ratio, and a near 20% five-year dividend growth rate.

It had a lot of the makings of a company I’d normally be interested in, but when I read through the Company Profile on Seeking Alpha and browsed around their website, I couldn’t wrap my head around what they actually do. As a result, Booz Allen Hamilton became the latest addition to my “too hard” pile (everyone should have one of these).

In my experience, your ability to be honest with yourself about which businesses are too over your head improves with time and experience. So does your sense for the qualities you want to see in a potential investment.

Generally speaking, I look to invest in dividend-paying companies that I understand, that are growing their sales, earnings, and dividends, have stable or expanding margins, a manageable debt-to-free-cash-flow ratio, and exceptional returns on capital.

The companies that meet this criteria form my "investable universe." They’re ones that I'd potentially consider adding to my portfolio.

I want to keep an eye on these companies, so I created a running list of them, which you can see here.

All the companies on this list are ones I'd like to explore further, but I need to spend more time researching them before I can be sure that I want to buy them. As my circle of competence (and, subsequently, my “investable universe”) grows, more companies will join this list, and some will likely be removed after further evaluation.

Overall, establishing this running list of the companies in my “investable universe” has helped narrow my focus and has given me a better idea of which ones I should get more acquainted with.

I highly recommend you start building a list of the stocks in your “investable universe.” You can start putting together this list by identifying all of the companies you find interesting and you can say, with confidence, that you understand. From there, you can narrow down the list to what you think are the strongest contenders over time.

With that said, I want to hear from you: What are some of the companies in your "investable universe?" Write to me here and let me know.

And a big thank you to all of the readers who responded to last week's newsletter! You can read some of the responses down below in the "Hot Takes" section. 👇

Dividend Investing Democratized

Join thousands of savvy investors in the pursuit of early retirement. Get Retire With Ryne delivered straight to your inbox every week as you build your perpetually growing, cash-flowing dividend stock portfolio.

IN MY PORTFOLIO 📈

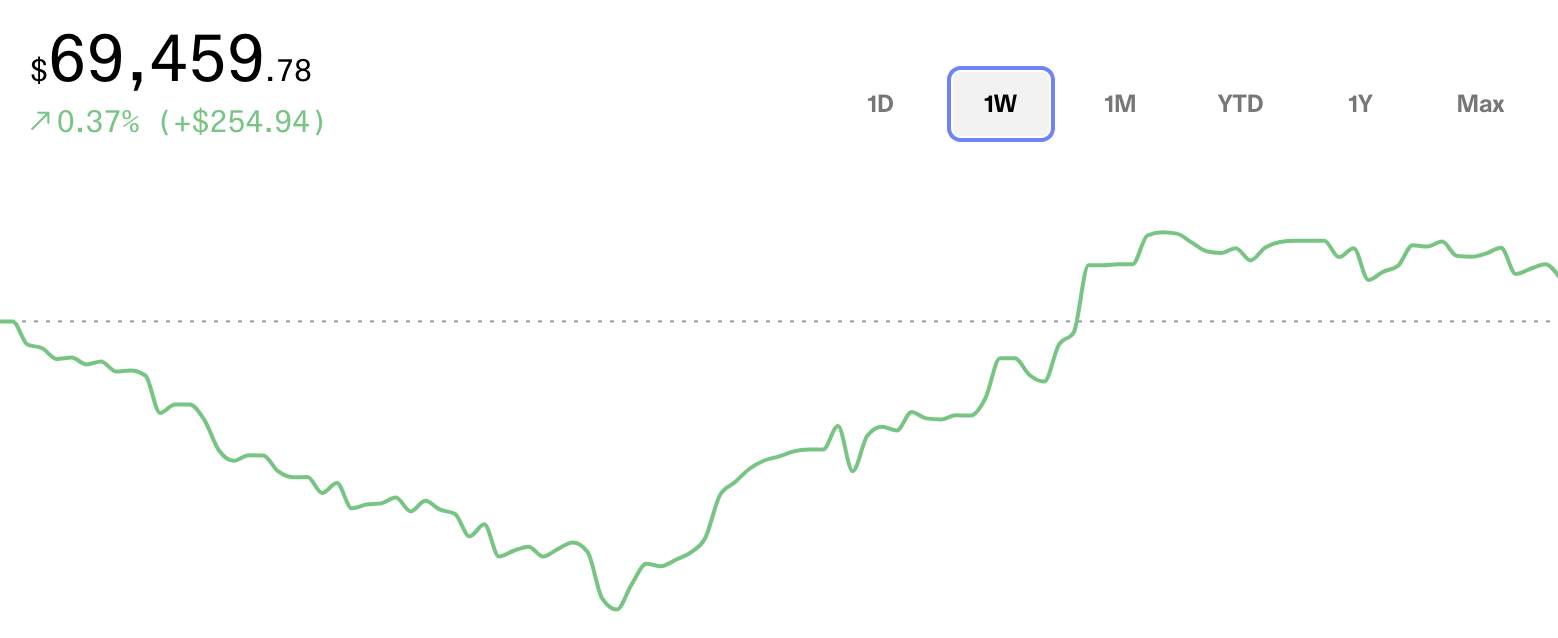

Track your portfolio for free with getquin. You can also follow mine there (@ryne) to see all of my purchases, dividends, and other updates in real-time.

ICYMI 🎥

All My Dividend Income In May | $68,300 PORTFOLIO

In May, I received 9 dividend payments from some of my favorite companies like Proctor and Gamble (PG) and Lowe's (LOW).

In this video, we’ll go through each of those payments so you can see all of my dividend income received for the month, as well as my total income received so far in 2024.

CAREFULLY CURATED 🔍

📺 Dividend Investing Mistakes - One of the best ways to learn from mistakes is to learn from the mistakes of others. In this video, you'll learn about the top seven mistakes new dividend investors make and how to avoid them.

🎧 Cash Flow Is King - Investors these days seem to be after share price appreciation more than anything else. This wasn't always the case though. Prior to the 1990s, investors were more interested in generating returns through cash-flowing dividend payments instead of share price appreciation. With that said, The Dividend Mailbox podcast believes cash-flow still reigns supreme, and this episode delves into all the reasons why.

📚 Lazy Work, Good Work - Productive work today does not look like productive work did for most of history. Most jobs throughout history were labor jobs that required doing things with your hands, while many jobs today are thought jobs that require you to think and make decisions. However, as Morgan Housel points out, a major issue is that many people in these thought jobs aren't given enough time to actually think.

SINCE YOU ASKED 💬

"What investing applications do you use?"

- @christanornido4527 | YouTube

This is actually one of the most common questions I get. I'll list out all of the different brokerages, portfolio trackers, stock research platforms, and everything else I use:

Brokerages: Charles Schwab (Main account) and M1 Finance (Roth IRA)

Stock News and Research: The WSJ/Barron's, and Seeking Alpha

Portfolio Trackers: My portfolio tracking spreadsheet and getquin

Other: The Investor's Almanac (coming soon) and Blossom

Have a question? Ask me here to see it featured in an upcoming newsletter.

HOT TAKES 🔥

Last week, I asked readers which discounted stocks they have their eye on for the month of June. Here are some of the responses:

Matt said: For undervalued or discounted stocks I'm keeping my eye on, they would be SBUX, PFE, & CMCSA.

Clay said: Watching for an entry point on WM. I’ve been watching this one for a while, and will probably execute after the June 12th FOMC. It’s a debate whether I want to add another position.

Mark said: BMY, UPS, and VICI are on the radar, but SBUX will be my first purchase in June. As long as SBUX is under $80, it will be very hard for me not to give it a lot of attention.

LAST WORD 👋

In case you didn't know, I do a live stream on my YouTube channel called the Dividend Happy Hour every Friday night at 5:00 PM PST / 8:00 PM EST.

This is one of the things I look forward to the most every week. It's a really fun opportunity to hang out with everyone in the community and hash out everything that's happening in the world of dividend investing.

If you can make it, I'd love to see you in this week's live stream. I think you'd have a lot of fun! Here's the link to the stream, and in the meantime, you can catch up on the most recent stream here.